Rayner Teo – Ultimate Price Action Course

How to Become a Consistently Profitable Trader Without Relying on Trading Indicators, Fundamental News, or Signal Services — Even if You Have ZERO Trading Experience

Do you know that 97% of traders lose money?

Yup, you read me right.

And this isn’t some number that I plucked out of thin air. Here’s why…

A group of researchers did a study on Brazilian day traders between 2013 and 2015.

And do you know what they found out?

- 97% of them lost money

- The top trader earned $310 per day

- 4% earned more than a bank teller (about $54 per day)

Clearly, the odds are against you.

But don’t worry because I’ll reveal how you can level the playing field, put the odds back in your favour and become a consistently profitable trader — without relying on contradicting news, confusing indicators, or conflicting signals. More on that later…

What is Price Action Trading?

Unlike trading indicators, fundamental news, or candlestick patterns…

Price action trading gives you an objective view of what the markets — with zero manipulation.

It’s a trading methodology which uses past prices (open, high, low, and close) to tell you what the market is doing — so you can make the correct trading decisions and generate consistent profits.

Now, let me show you what Price Action Trading can do…

You can “predict” what the markets will do with heightened accuracy

Let me tell you a secret:

The price can predict the future better than anyone of us.

If you don’t believe me, take a look for yourself…

EUR/USD is in a downtrend before the ECB cuts interest rate:

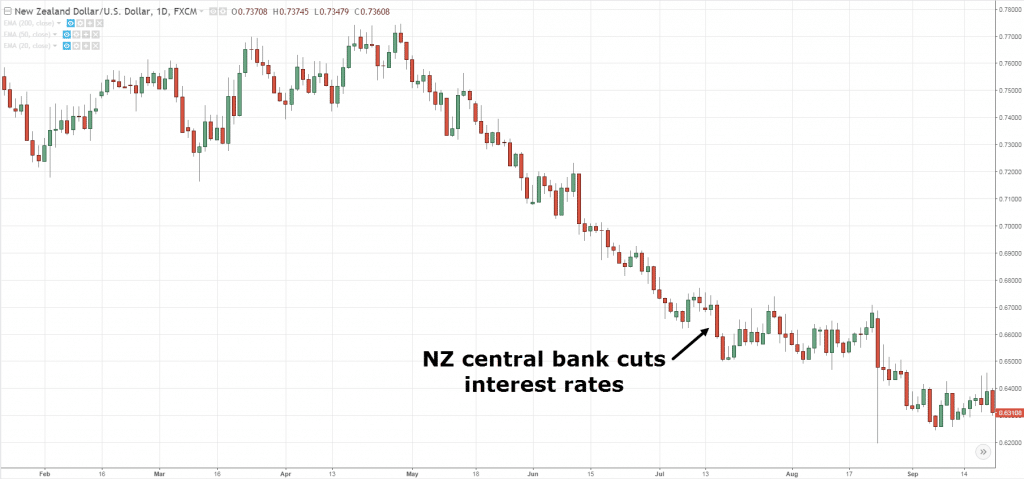

NZD/USD is in a downtrend before the NZ central bank cuts interest rate:

Clearly, it’s obvious the price leads the news.

So, if you’re always trying to predict where the market is going, then look no further.

Because all you need to do is just follow price and you’ll be more accurate than 90% of the analysts out there.

You trade what you SEE, not what you think

Here’s the thing:

The majority of trading indicators (like Moving Average, RSI, Stochastic, ADX, ATR, Bollinger Bands, and etc.) are a derivative of price.

This means the line you’re seeing on your indicator is derived by applying a formula to the price.

Now…

What if your RSI indicator is overbought and the Stochastic indicator is oversold, at the same time?

Won’t you have conflicting signal?

Indeed.

But no worries!

You can adjust the settings of your RSI indicator and make it oversold.

So now, both your RSI and Stochastic indicator are sending out the same “signal”.

But let me ask you…

Does it make sense?

Heck no!

Why would you manipulate an indicator to fit your bias?

It doesn’t make sense.

Remember, you’re supposed to trade what you see, not what you think.

However…

You won’t have this problem if you choose to focus on Price Action.

What you see is what you get.

No bias. No agendas. No manipulation.

Agree?

You have absolute control over your trading results and you don't have to rely on anyone

Now…

Someone who relies on a black-box algorithm, magic systems, or signal service isn’t a trader.

Why?

Because they are “blindly” following orders.

And the worst thing is…

They GIVE UP the power to be in control.

But of course, you won’t let it happen to you.

Because as a price action trader, you have absolute CONTROL over your trading results.

You make decisions like:

- Where you’ll enter the trade

- Where you’ll set your stop loss

- Where you’ll exit your winners

- How much to risk on each trade

- What are the market conditions you’ll trade

- How to manage your trades from start to finish

And here’s the beauty of it…

When you have control of your actions, you can make tweaks and improvements to your trading.

The outcome?

You make more profits in the long run (that no systems, robots, or algorithms can match).

Now, I’ll admit.

This isn’t for everyone.

Because not everyone is meant to be a trader.

But if this sound like what you’re looking for and you’re prepared to put in hard work to reap the benefits of what trading can offer, then read on…

Now…

You know indicators are a derivative of price (after applying a formula to it), so naturally, you can expect it to “lag” the markets.

This means if you rely on indicators for your entries, you’ll be slower compared to someone who trades based on price action.

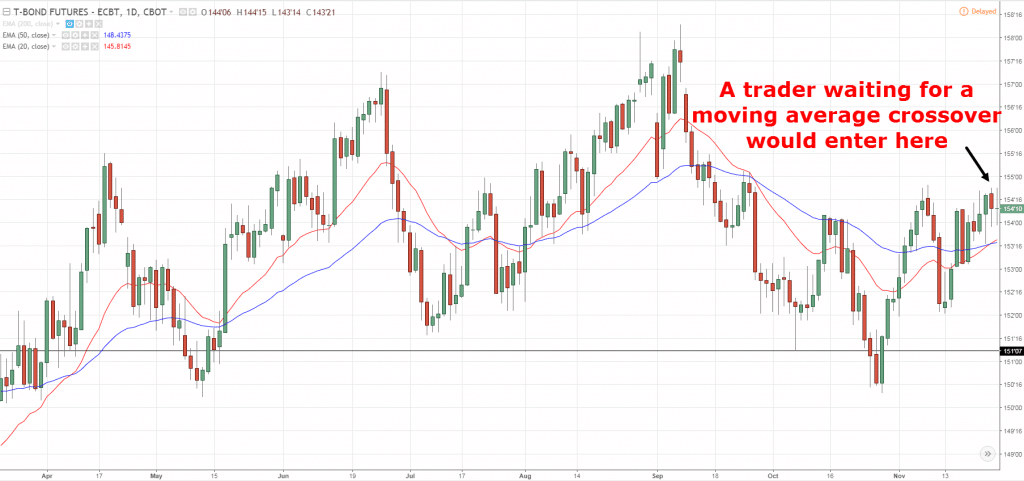

Here’s an entry based on moving average crossover:

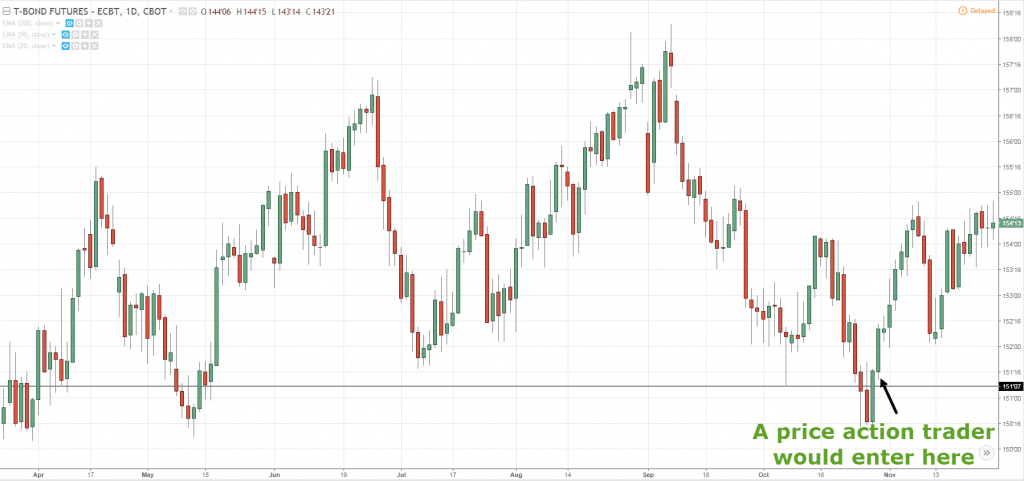

Here’s an entry based on price action:

Can you see the difference?

Imagine…

How much more profitable you’ll be if you can time your entries with Price Action?

Now, unlike other trading systems which only work in certain markets, Price Action Trading can be applied to all markets.

How’s that possible?

Because Price Action is not a trading system that “spits” buy and sell signals.

Instead…

It’s a methodology that allows you to use the correct trading strategy in the right market conditions.

This means if the market changes so do your trading strategy!

The end result?

You’re adaptable to the different market conditions and you can be confident your trading approach will work for years to come.

Moving on…

You can be a consistently profitable trader without paying attention to the news

Now I’ll honestly say, fundamental news is NOISE to your trading.

I’m sure you’ve seen the market rallies on bad news and collapse on good news. And you’re probably wondering:

“What the heck is happening?”

Well, I’ve no idea too.

The only thing I know is… Price is KING.

This means you don’t know anything about fundamentals like the price to book value, financial ratios, interest rates, GDP, assets, liabilities, and etc.

And… you still can be a consistently profitable trader — if you follow price.

Here’s the proof:

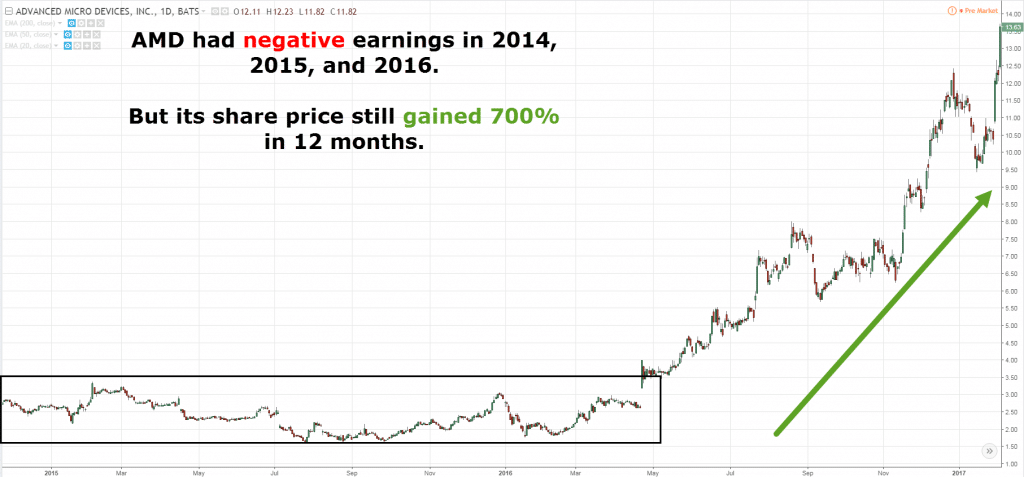

AMD had 3 years of negative earnings but the stock rallied 700% in 12 months. If you shorted AMD based on fundamentals, it would really hurt.

But what if you followed price?

You would have made a profit by being on the RIGHT side of the market.

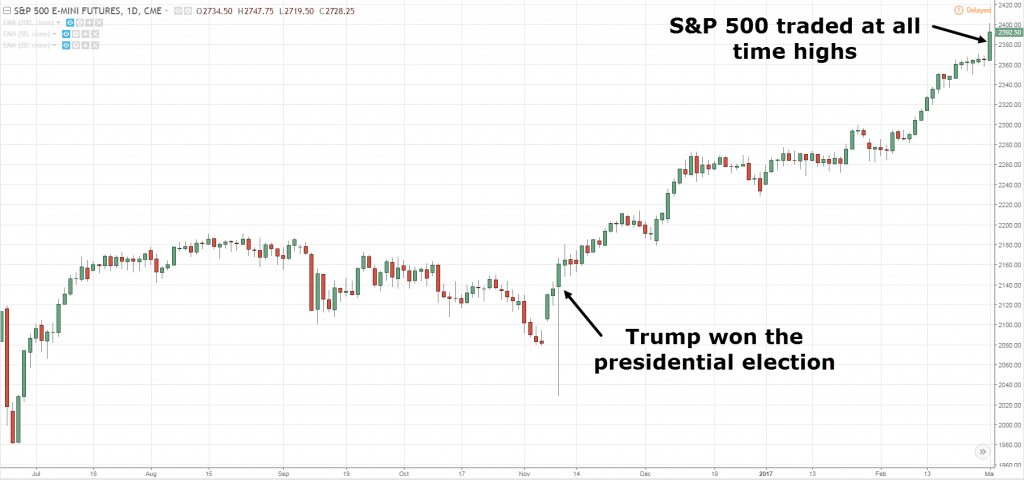

Or how about the US Presidential election?

If you recall:

The news and media were extremely bearish if Donald Trump gets elected as president because of his policies, his character, the Trans-Pacific Partnership (TPP), and etc.

But look what happened…

The S&P 500 broke to all-time highs.

If you shorted this market based on the media and analyst reports, then you’re probably toasted.

So my point is this…

The market doesn’t care about you, me, fundamental reports, news, media, analysts, and etc.

The only thing that matters is, PRICE.

Now imagine this…

You have the unfair advantage to read price action like a professional trader and anticipate market turning points with deadly accuracy.

You can better time your entries and exits so you can minimize your losses and maximize your gains.

You can read the market with precision and know how to profit in different market conditions.

Now if you have this skill…

…then I’m sure you’ll agree you have a good chance of being a consistently profitable trader, right?

And that’s why I’ve developed The Ultimate Price Action Trader — so you can become a consistently profitable trader without relying on trading indicators, fundamental news, or candlestick patterns.

Get Ultimate Price Action Course or the other courses from the same one of these categories: Price Action, Rayner Teo, New Update, Ultimate, Course, Forex for free on Share Cloud Link.

Share Course Ultimate Price Action Course, Free Download Ultimate Price Action Course, Ultimate Price Action Course Torrent, Ultimate Price Action Course Download Free, Ultimate Price Action Course Discount, Ultimate Price Action Course Review, Rayner Teo – Ultimate Price Action Course, Ultimate Price Action Course, Rayner Teo.